How Work Ride Works

Workride is a free benefit scheme in which employees can benefit from a 32-63% cost offset on the sale price of a new bike, e-bike or scooter using tax exemptions. Staff get to choose any bike, e-bike or scooter for their commute from approved stores across New Zealand.

WORKED EXAMPLE

Workride operates on a "salary sacrifice" model, where employees opt to reduce their pre-tax salary to lease a bike or scooter. In addition to the tax savings, a small proportion of other contributions like student loans or Kiwisaver may also be redirected towards the ride, depending on its value. After the 12-month lease of your ride equipment, you will receive an email directly from Workride outlining your ‘Next steps’ options regarding ownership of the ride equipment.

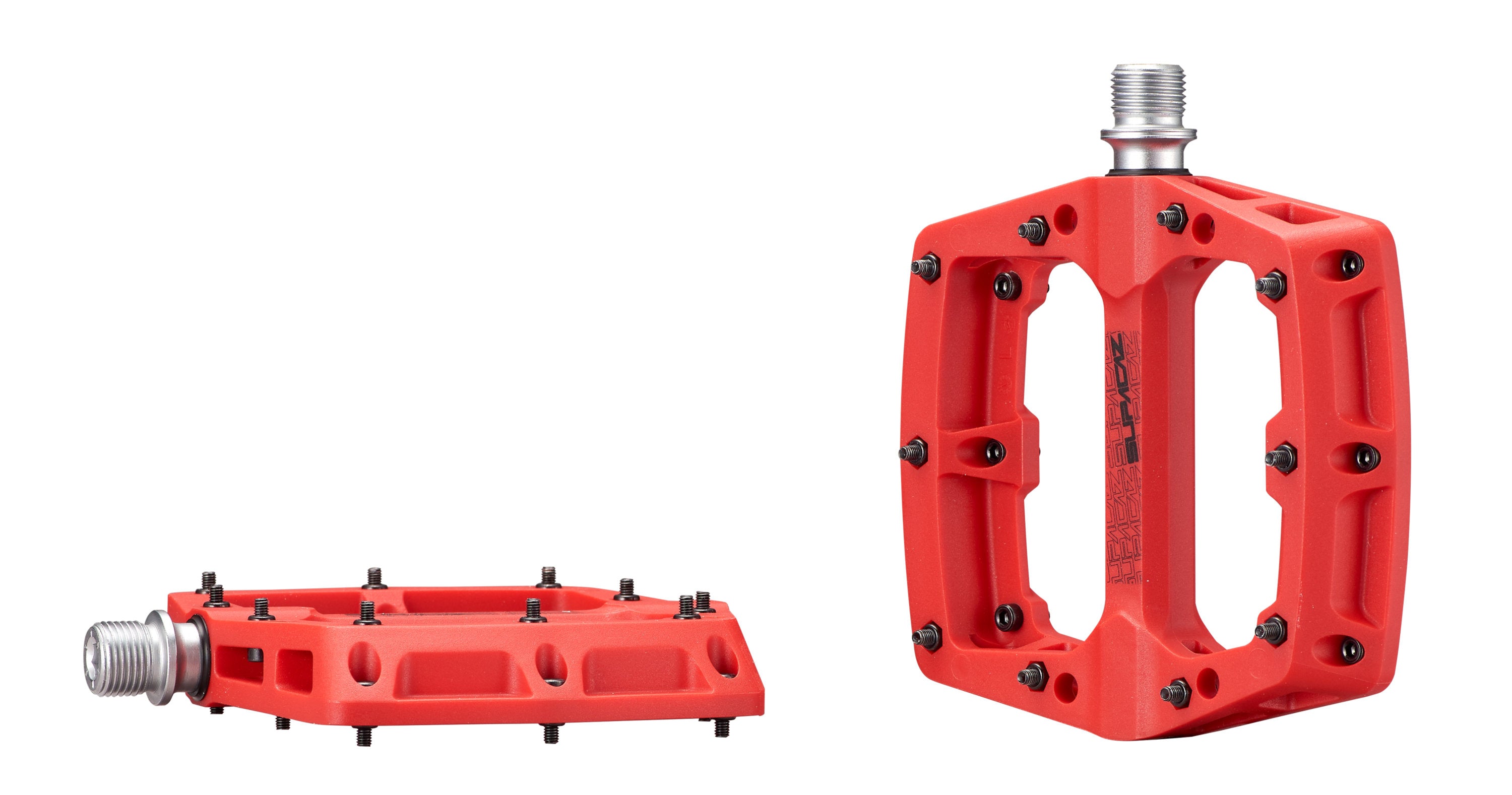

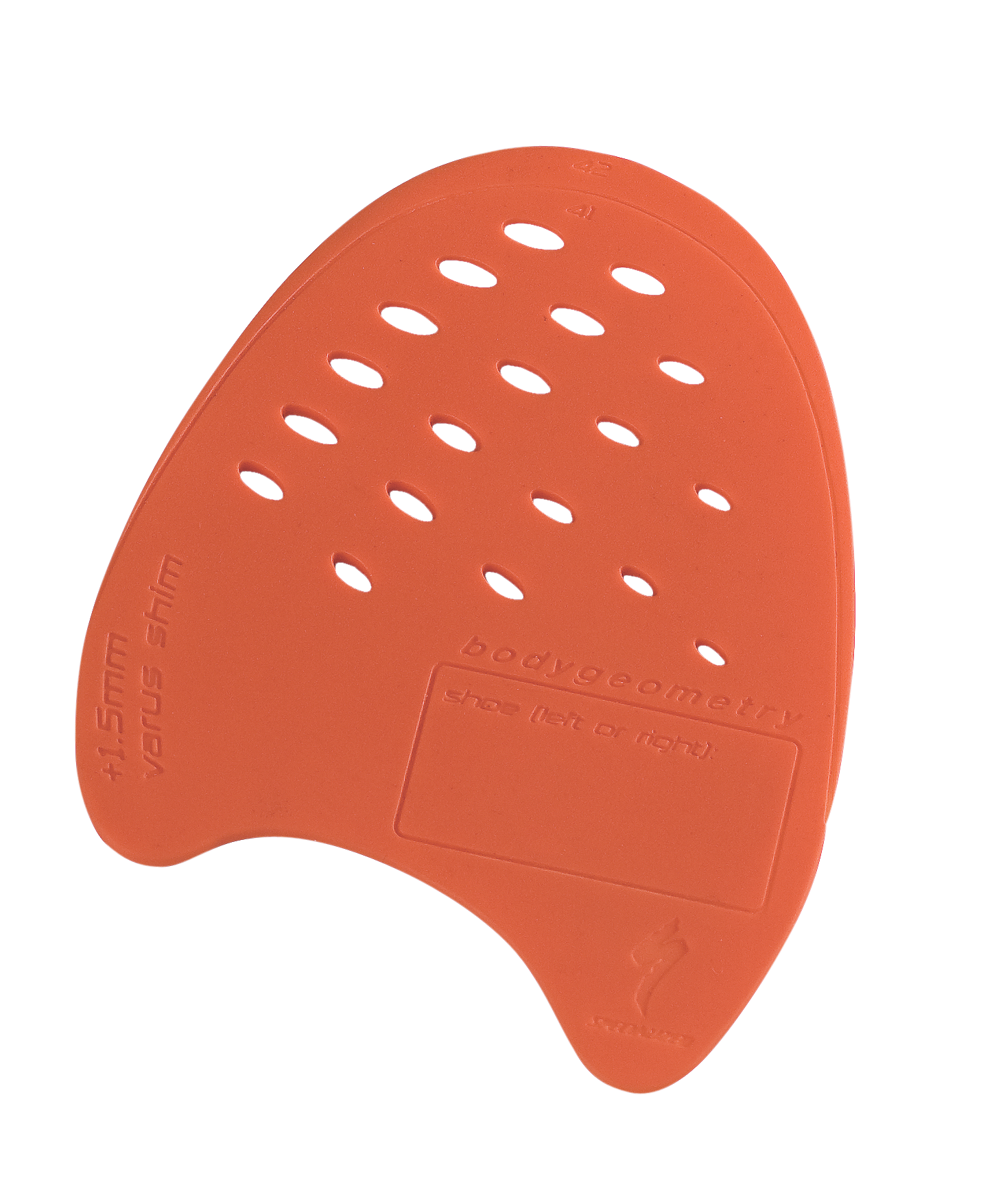

For example, an employee with a $80,000 salary, 4% Kiwisaver, and Student loan, chooses a Specialized Bike valued at $6380, but it’s on sale in-store at $5200.

Through Workride, they salary sacrifice $100 pre-tax and their weekly take-home pay impact is only reduced by $49, totalling an annual net contribution of only $2572 towards the ride. This arrangement benefits both the employee and employer, offering tax savings and financial flexibility.